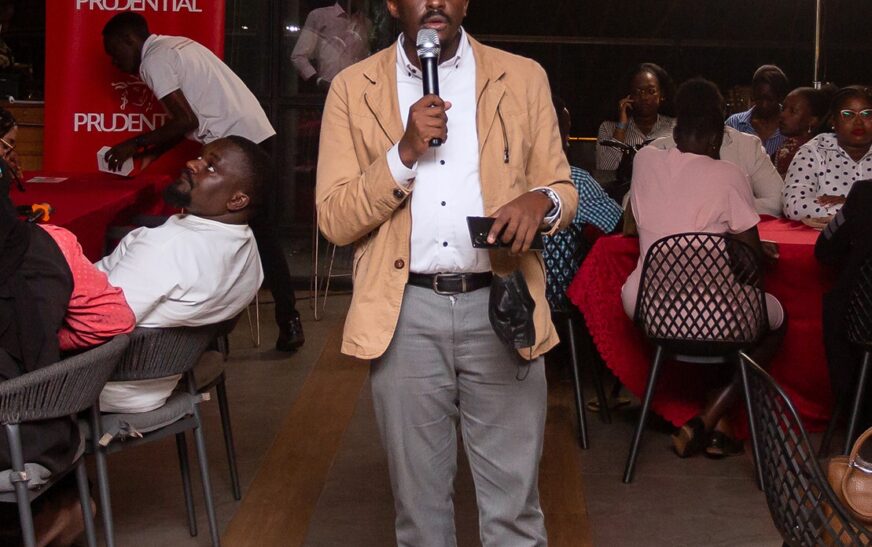

Prudential Uganda has hosted a landmark edition of its flagship financial literacy initiative, the Prudent Kyoto Masterclass Series.

Prudent Kyotos” series is a financial literacy initiative aimed at equipping Ugandans with essential knowledge and tools for financial security. This event draws inspiration from the traditional African fireplace, the “Kyoto,” symbolizing warmth, stability, and community.

This 10th edition marks a powerful return, not just in number, but in impact, as it features two extraordinary keynote speakers: Janat and Francis, long-time Prudential clients whose inspiring life journeys have been shared in recent testimonial videos.

During the session, Francis Mugoya, a social worker and one of the featured speakers, highlighted his experience with disciplined saving and receiving a full policy payout.

“The discipline in my journey of saving through an insurance policy helped me acquire land, an investment I never imagined possible at the beginning of my journey.”

Mugoya’s story is one of many impactful narratives that the Prudent Kyoto masterclass has highlighted since its launch. It continues to create space and equip Ugandans with practical tools and expert guidance to build financial resilience.

Speaking at the event, the CEO of Prudential Uganda, Tetteh Ayitevie, reaffirmed the company’s long-term commitment to building a financially literate society.

“Today, I am proud to hear from successful Ugandans who have benefited from the insurance solutions and plans we offer in the Ugandan market. These stories not only inspire us to continue our work, but also serve as powerful, real-life examples that show anything is possible.” They represent the very heart of our mission.” For Every Life, For Every Future.

He added, “Every story we’ve heard tonight proves that financial freedom is possible with the right plan and consistent action. This is how we build not just a customer base, but a confident and financially resilient society.”

Despite progress, Uganda still faces a steep challenge: fewer than 16% of Ugandans have formal savings plans, according to Bank of Uganda statistics. Prudential sees structured saving and protection products like the Prudent Life Plan as essential tools in shifting this trend.

“Our goal with Prudent Kyoto has always been to make financial planning practical and deeply human,” Ayitevie added. “This edition reinforces that mission. As we celebrate our 10-year anniversary, we reflect on not just our business growth, but the lives we’ve touched and transformed.” Ayitevie concluded.

With each edition, Prudential Uganda strengthens its vision of empowering a generation that is financially informed, protected, and prepared for the future.