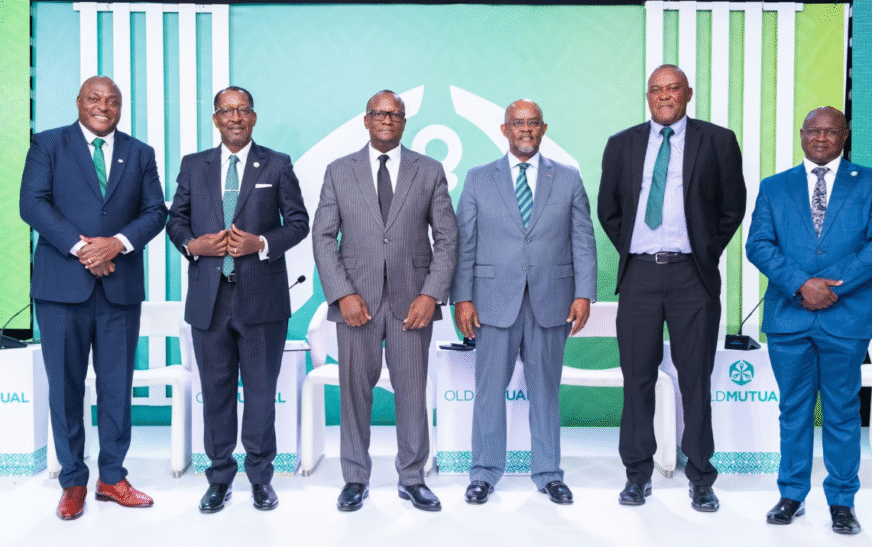

UAP Old Mutual has rebranded to Old Mutual, marking an exciting new chapter for the business in Uganda.

The transition is part of a Group-wide rebrand that unifies all operations across Africa under one trusted and recognisable brand – Old Mutual.

Speaking at the launch, Zaccheus Kisesi, the Investment Group Managing Director said, “For our customers and partners, this rebrand does not change the value, trust, or service you have always received from us,”

He said the rebranding offers a renewed focus on you, ensuring that your financial goals remain at the heart of everything we do. This is your assurance that while our name has changed, our commitment to you remains the same.

Old Mutual East Africa Group CEO, Arthur Oginga added “We believe that this rebrand will strengthen our business, enabling us to leverage more synergies across the continent, backed by Old Mutual’s 180-year heritage,”

He said with this rebrand, we are renewing our promise to help customers and communities achieve their lifetime financial goals, while unlocking new possibilities for financial wellness. Through this rebrand, and with the scale and expertise of the Old Mutual Group, we are excited to strengthen our role as a trusted financial partner in Uganda. A new chapter of financial wellness truly begins today with Old Mutual.

The rebrand is a significant step for Old Mutual in East Africa, where operations were previously run under a joint venture -UAP Old Mutual. Old Mutual acquired UAP in 2015 and has since been consolidating its brand footprint across the region, beginning with Rwanda in 2021, Kenya in 2023, and now Uganda in 2025.

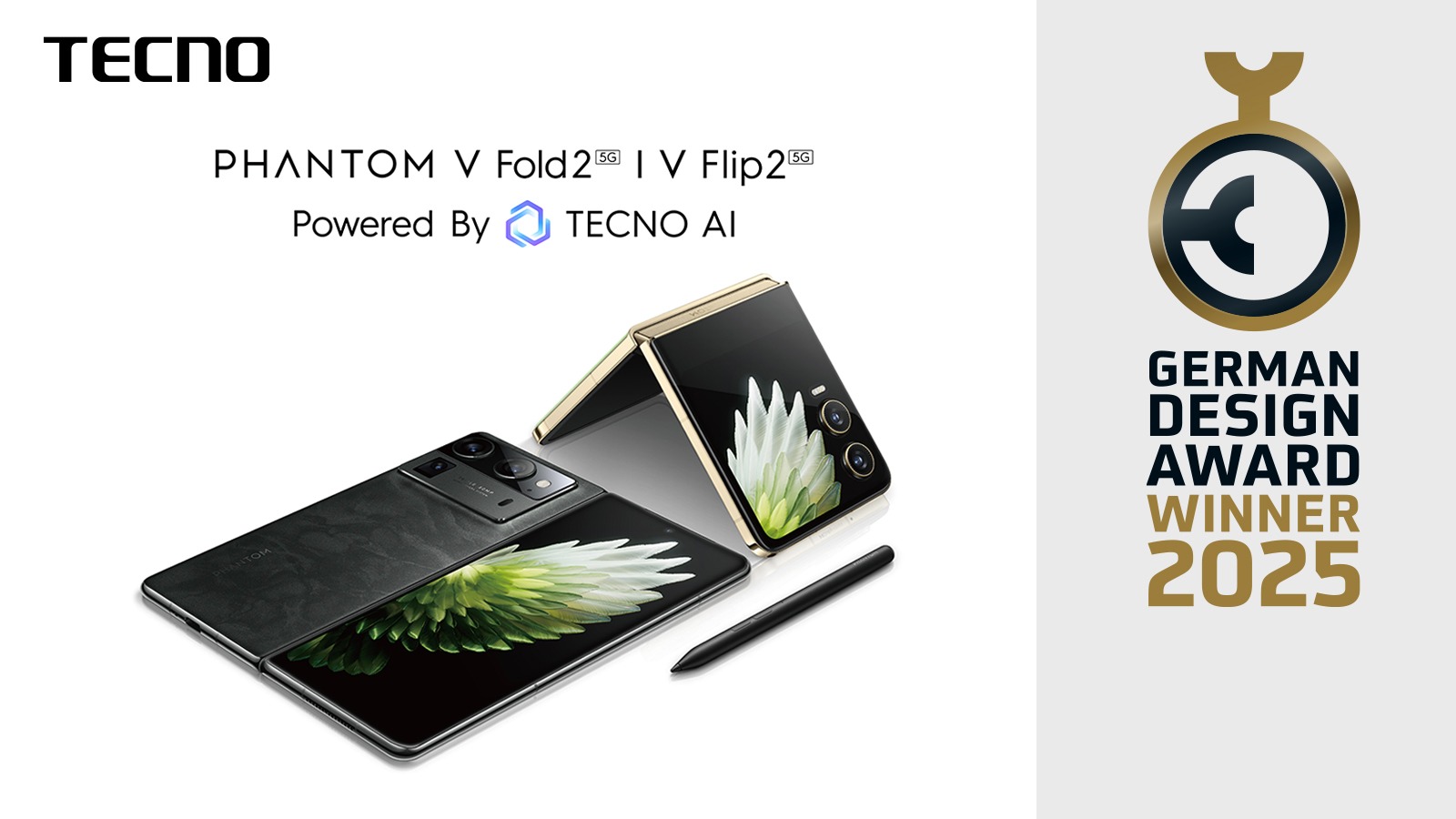

Old Mutual Uganda has invested heavily in digital innovation to enhance customer experience and accessibility. The company has implemented integrated digital self-service platforms, mobile-first insurance solutions, and online investment tools designed to make financial planning simpler, faster, and more convenient. These are across web, USSD and mobile applications.

Some of the digital access products include motor comprehensive, travel, Somesa, travel, sure deal, Unit trust client portals among others. Old Mutual also recently invested in a private wealth solution to provide high-net-worth clients with personalized, tech-enabled investment management and advisory services, giving them real-time visibility, control, and convenience in managing their portfolios.

These advancements reflect Old Mutual’s commitment to meeting the evolving needs of today’s customers and supporting Uganda’s transition toward a more connected and inclusive financial ecosystem.

Old Mutual also reaffirmed its long-term commitment to Uganda, continuing to invest in the country through strong distribution networks, deep-rooted local partnerships, and financial stability.