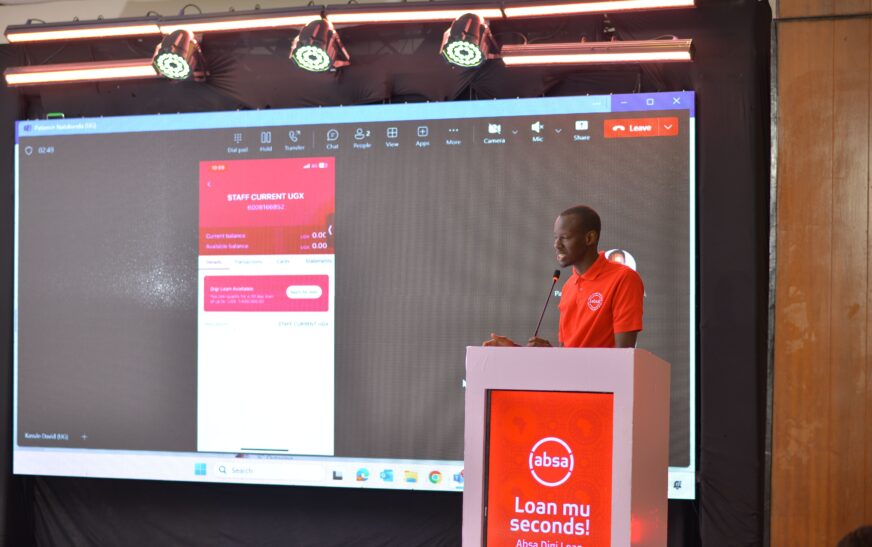

In a move to meet the growing demand for fast, convenient, and paperless banking, Absa Bank Uganda has introduced two new digital innovations: Digi Loans and Online Account Opening.

The fully self-service solutions, accessible via the Absa Mobile Banking App, Internet Banking, and Hello Money (USSD), enable customers to manage their finances anytime, anywhere.

With the new Digi Loan, eligible customers can instantly borrow between Shs 20,000 and Shs 2 million with no paperwork, no queues, and no branch visit required, provided they have held an Absa account for at least 12 months. The application, approval, and disbursement process can be completed in under seconds.

The launch comes at a pivotal moment in Uganda’s digital journey. According to the Uganda Communications Commission, as of September 2024, the country had 45.6 million registered mobile money accounts, with 30.4 million active users, underlining the increasing role of digital financial services in advancing financial inclusion. Smartphone penetration now stands at approximately 33%, driven by greater device affordability and the popularity of mobile-first platforms, especially among youth.

Uganda’s young population, with over 75% under the age of 30 (Uganda Bureau of Statistics, 2024 Mid-Year Projection), is powering this digital shift. Their preference for mobile-led solutions is accelerating the demand for flexible, accessible financial tools that match their fast-paced, digital lifestyles.

“This launch reflects our continued commitment to enhancing efficiency and empowering our customers by making banking truly accessible and on-demand,” said Michael Segwaya, CFO and Executive Director at Absa Bank Uganda. “These services align with Uganda’s digital economy ambitions and deliver practical solutions that eliminate the need for queues, paperwork, or branch visits.”

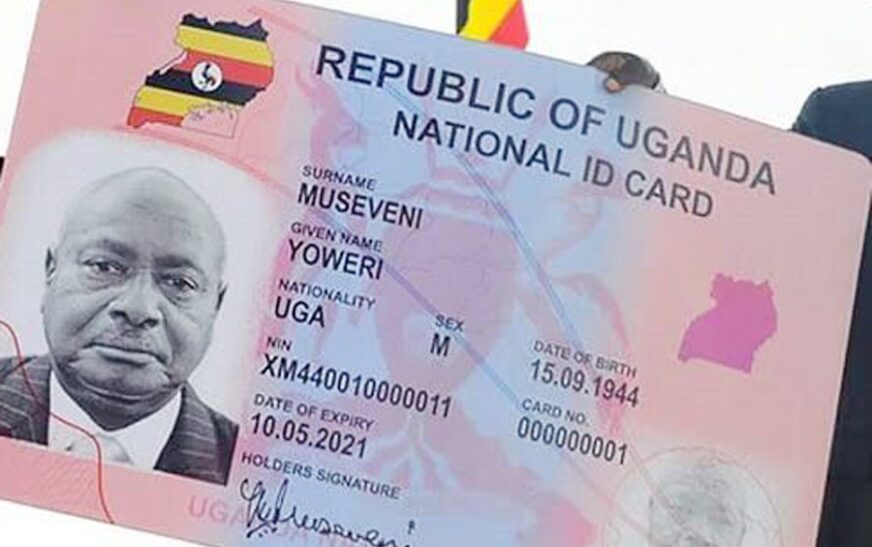

Complementing the digital loan service is Absa’s new Online Account Opening portal, which transforms customer onboarding into a fully self-service experience. Individuals can now open an Absa account in just a few steps, verifying their identity using a National ID, uploading photos, and selecting their preferred services, using either a smartphone or computer.

“We are redefining how customers join and experience the bank,” said Moses Rutahigwa, Retail and Business Banking Director. “This digital onboarding solution simplifies and accelerates the journey, reflecting our vision of a modern, tech-forward banking experience built around customer convenience.”

These innovations also respond to evolving market needs. In 2023 alone, over UGX 9.5 trillion worth of mobile money loans were disbursed in Uganda (Bank of Uganda, 2024), underscoring widespread demand for instant, accessible credit, a space traditionally dominated by mobile network operators.

“This is more than just convenience,” added Rachel Rwakatungu, Credit Director at Absa Bank Uganda. “It’s about extending real financial empowerment, giving people the tools to access and manage credit quickly, safely, and responsibly.”